Bitcoin Exchanges:The Cornerstone of the Cryptocurrency Ecosystem

摘要:Intherapidlyevolvingworldofcryptocurrency,Bitcoinexchangesserveasthevitalbridgebetween...

In the rapidly evolving world of cryptocurrency, Bitcoin exchanges serve as the vital bridge between traditional finance and the digital asset economy. As specialized platforms facilitating the buying, selling, and trading of Bitcoin (and often other cryptocurrencies), they play an indispensable role in price discovery, liquidity provision, and mainstream adoption. For global users—whether retail investors, institutions, or traders—understanding Bitcoin exchanges is key to navigating the crypto landscape, especially as their operations and regulations continue to mature.

What Is a Bitcoin Exchange?

A Bitcoin exchange is an online marketplace that allows users to exchange fiat currencies (such as USD, EUR, or JPY) for Bitcoin, or trade Bitcoin against other cryptocurrencies (e.g., Ethereum, Tether). These platforms vary widely in functionality: some focus on simple spot trading (buying/selling at current market prices), while others offer advanced features like margin trading, futures, options, and staking. Exchanges can be centralized (CEXs) or decentralized (DEXs), with the former dominating in terms of trading volume and user base.

Centralized vs. Decentralized Exchanges

The majority of Bitcoin trading occurs on centralized exchanges (CEXs), such as Coinbase, Binance, and Kraken. CEXs are operated by companies that act as intermediaries, holding users’ funds and managing order books to match buyers and sellers. They offer high liquidity, user-friendly interfaces, and robust customer support, making them popular among beginners. However, their centralized nature also introduces risks, such as hacking incidents (e.g., the 2018 Mt. Gox hack) or regulatory scrutiny over custody and compliance.

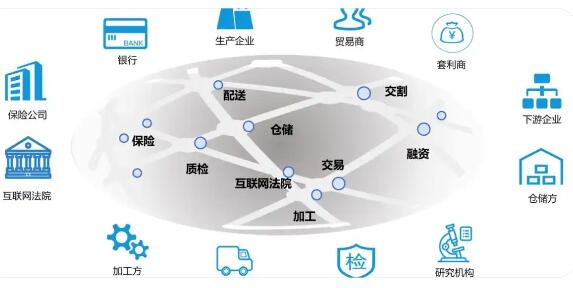

In contrast, decentralized exchanges (DEXs), like Uniswap or Bisq, operate without a central authority. Trades are executed directly between users via smart contracts on blockchain networks, eliminating the need for intermediaries. DEXs enhance user control over funds and reduce counterparty risk but often suffer from lower liquidity, higher fees, and a steeper learning curve, limiting their appeal for large-scale Bitcoin trades.

Key Functions and Features

Bitcoin exchanges are more than just trading venues—they are multifaceted platforms with several core functions:

- Liquidity Provision: By aggregating buy and sell orders, exchanges ensure that users can execute trades quickly and at stable prices, reducing slippage (the difference between expected and actual trade prices).

- Price Discovery: As the most active trading hubs, exchanges determine Bitcoin’s market price through real-time supply and demand dynamics, serving as a benchmark for the global crypto market.

- Security Measures: Reputable exchanges implement advanced security protocols, including two-factor authentication (2FA), cold storage (offline storage of funds), and encryption, to protect against theft and fraud.

- Compliance and Regulation: To combat money laundering and fraud, many exchanges adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements, especially in regions like the EU, U.S., and Japan.

Challenges and Regulatory Landscape

Despite their importance, Bitcoin exchanges face significant challenges. Regulatory uncertainty remains a top concern: countries like China have banned crypto exchanges outright, while others, such as the U.S. and EU, impose strict licensing and reporting requirements. This patchwork of regulation complicates global operations and can impact user access.

Security is another persistent issue. Even with robust safeguards, exchanges remain prime targets for hackers, with billions worth of Bitcoin stolen over the years. High-profile breaches have eroded trust, prompting exchanges to invest heavily in insurance and custodial solutions to reassure users.

The Future of Bitcoin Exchanges

As Bitcoin gains mainstream acceptance, exchanges are evolving to meet growing demand. Institutional adoption has driven the rise of regulated, custodial exchanges tailored to large investors, while the integration of decentralized finance (DeFi) principles is blurring the line between CEXs and DEXs. Additionally, innovations like lightning network integration are improving transaction speed and reducing fees, making exchanges more efficient for everyday users.

In conclusion, Bitcoin exchanges are the backbone of the cryptocurrency ecosystem, enabling access to Bitcoin and shaping its market dynamics. While challenges like regulation and security persist, their ongoing innovation and adaptation will play a pivotal role in bridging traditional finance and the digital asset future. For anyone engaging with Bitcoin, understanding these platforms is not just useful—it is essential.